Imagine being able to see into the future. Imagine predicting sales trends, financial market changes, or what customers will want. That’s what predictive analytics offers. At its heart, linear regression analysis stands out. It provides the insights needed for smart decision-making. With data, linear models become a crystal ball, guiding companies as they navigate through uncertain industry waters.

In retail, things can change fast. Yet, predictive modeling finds patterns in what seems random. Using past sales data, along with marketing budgets and consumer trends, businesses can predict their financial future. This allows them to plan better. This method of turning numbers into data insights opens up new possibilities. Linear regression doesn’t just help retail. It’s also key in finance and technology, offering a way for experts to chart their path.

Table of Contents

ToggleKey Takeaways

- Linear regression is essential for predictive analytics, helping businesses find important insights for planning.

- The success of predictive modeling depends on good data and choosing the right variables.

- Linear models can predict things like sales and what customers want, influencing decision-making.

- Metrics like R-squared are crucial for checking a model’s fit, showing how well linear regression analysis can predict.

- To fully benefit from data insights, it’s important to follow linear regression rules and check the model’s accuracy.

Demystifying Linear Regression for Predictive Analytics

At predictive analytics’ core sits the regression model, crucial for showing how variables connect. Linear regression zeroes in on how independent variables affect a dependent one. This helps us predict what comes next with ease.

Understanding the Basics of Linear Regression

Linear regression finds the clearest line connecting the dependent variable to predictors. It takes a straight-line approach and uses past data for future forecasts. This method is both clear and predictive.

Applications of Linear Regression in Predictive Analysis

It finds use in many areas like economics, healthcare, and marketing. Companies, for instance, forecast sales by linking them to ad spending. This helps shape better marketing plans.

Linear Regression: From Historical Data to Future Insights

Linear regression turns past data into insights about what’s ahead. It calculates regression coefficients to show how changes in predictors move the dependent variable. This makes business and research choices more informed.

| Field | Uses of Linear Regression |

|---|---|

| Economics | Forecasting economic trends, employment rates |

| Healthcare | Modeling disease progression, patient outcomes |

| Marketing | Analyzing the impact of advertising on sales |

Key Components and Assumptions of Linear Regression

It’s important to know the basics of the linear regression equation. This helps us make accurate prediction models. We dive deep into the key assumptions and important parts of linear regression. By doing this, we see how they make the linear model work well.

The start of any linear regression analysis is the independent variables. They play a big role in deciding the outcome of the dependent variable. The variables relationship is seen as straight. This means a change in one independent variable changes the dependent variable in a steady way.

We think the relationship is straight. This means the best-fit line through the data points is a straight line. You can see this on a scatter plot.

Now, let’s dig into some key parts and assumptions:

- Linearity: There must be a straight line relationship between dependent and independent variables.

- Independence: Observations should not affect each other, unless included in the model.

- Homoscedasticity: Error terms should have a steady spread across the regression line.

- Normal Distribution of Errors: Residuals should be normally spread around the regression line for precise predictions.

This table shows why each assumption is vital for a linear model:

| Assumption | Description | Impact on Model |

|---|---|---|

| Linearity | Linear relationship between independent and dependent variables. | Makes predictions accurate and coefficients relevant. |

| Independence | Observations must not affect one another. | Stops biased estimates, making the model more trustworthy. |

| Homoscedasticity | Steady variance of residuals for independent variables. | Important for confident intervals and tests. |

| Normal Distribution of Errors | Residuals normally group around the regression line. | Crucial for accurate parameter estimates. |

By sticking to these key assumptions, we can create a strong linear regression equation. Not just high in accuracy, but it also shows the relationship between variables clearly. This clear understanding allows us and stakeholders to make smarter choices. These choices are based on the predictions from the linear model.

Building Precision in Predictive Analytics with Linear Regression

Linear regression is key in making accurate, data-driven decisions. It helps predict outcomes better, allowing for strategic moves across various industries.

Building Accurate Predictive Models with Linear Regression

Selecting and analyzing important data is crucial for precise predictive models. Linear regression finds these important variables. This way, businesses can face future challenges with a detailed plan.

Interpreting Regression Coefficients for Strategic Insights

Understanding the regression model’s coefficients gives deeper insights. It shows how different predictors affect outcomes. Thus, businesses can craft strategies focusing on the most influential factors.

Enhancing Decision-Making with Linear Regression Outputs

Linear regression outputs are vital for better decision-making. They provide a glimpse into future trends. This is helpful in finance, healthcare, and marketing for improving operations and staying ahead.

Using regression analysis helps in making informed decisions. It supports long-term business goals with a data-driven success plan.

Advanced Techniques in Linear Regression Analytics

In the world of predictive analytics, advanced linear regression techniques are key. They help us deal with more complex data smoothly. Techniques like Lasso regression, Elastic Net regression, and regularization sharpen our models. They make them more precise and reliable.

Elastic Net regression is special because it uses both ridge and Lasso penalties. This is great for data that has a lot of overlap. It works well when Lasso can’t handle things on its own. Meanwhile, Lasso regression is great at picking the most important features. It keeps the model simple without losing its power to predict.

- Elastic Net regression for balance and stability in model training

- Lasso regression for feature selection and model simplicity

- Integrating regularization to prevent overfitting and enhance model relevance

These advanced methods are not just for building models. They also help us understand which predictors are important in our models. Below, you’ll find a table comparing these techniques. It shows their main differences and how they’re used.

| Technique | Primary Use | Advantage |

|---|---|---|

| Lasso Regression | Feature Selection | Reduces model complexity |

| Elastic Net Regression | Handling Multicollinearity | Balances feature selection with model stability |

| Regularization | Preventing overfitting | Improves model validity on unseen data |

Using advanced linear regression techniques lets us create strong models. These models can predict accurately, even with complex data.

Mastering Interpretation in Linear Regression Analytics

In predictive modeling, mastering interpretation of regression analysis results is key. Knowing the R-squared value and other outputs helps us make smart choices. It boosts the accuracy of our predictions too. Let’s look at how these numbers are the base of good predictive models.

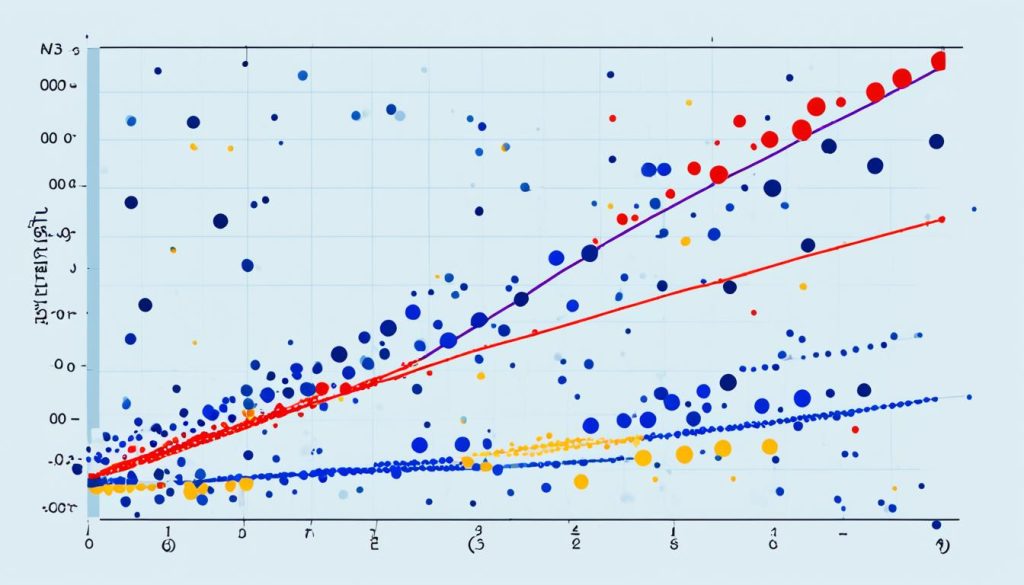

The R-squared value is really important when looking at regression results. It shows how much of the variable variation the model explains. A higher R-squared means the model fits the data better. So, this number is crucial for checking how good our model is.

Precision in interpreting these numbers is vital for reliable predictions. A high R-squared value signals a strong model. But, we must think about the data context and the variables. Different industries see the same R-squared value in different ways. It depends on their standards and how complex their data is.

- Predictive Modeling: Utilizing R-squared to gauge model success.

- Regression Analysis Results: Interpreting coefficients to predict future trends.

- Mastering Interpretation: Understanding the limits of correlation and causation, ensuring analytical accuracy.

| Aspect | Importance | Role in Predictive Modeling |

|---|---|---|

| High R-squared Value | Indicates a potentially strong model | Key in validating the effectiveness of the model’s predictive capabilities |

| Coefficient Analysis | Crucial for identifying influential variables | Helps in refining models for better accuracy |

Being great at predictive modeling means digging deep into regression analysis. By mastering these interpretations, we sharpen our analytical abilities. We get clearer, more useful insights. This skill improves our predictive modeling greatly. It also changes how we make decisions based on data in many areas.

Exploring Real-World Applications and Case Studies in Linear Regression

In the world of predictive analytics, linear regression is key. Companies in many industries use it to predict future trends. For example, in telecommunications, they use it to find out what may cause customers to leave. By understanding these reasons, companies can create strategies to keep their customers, showing how important linear regression is for planning.

In retail, linear regression helps manage inventory and predict sales. By analyzing past sales, retailers can estimate future needs, keeping the right amount of stock. This makes operations smoother and keeps customers happy by making sure products are available. Here, linear regression’s role in improving business and customer relationships is clear.

Business forecasting with linear regression is also crucial in finance. Banks and investment firms use it to foresee loan defaults or stock market movements. Predictions from regression models aid in crafting strategies to reduce risks and make smart investment choices. By analyzing past data and predicting future trends, linear regression proves versatile for experts. These examples highlight how linear regression provides valuable insights for better business decisions.

Exploring Real-World Applications and Case Studies in Linear Regression

Understanding the Basics of Linear Regression

Linear regression is a tool to figure out how things relate to each other. We try to predict one thing based on others. This helps us make decisions using data.

Applications of Linear Regression in Predictive Analysis

Linear regression is used in many areas like economics, healthcare, and marketing. It helps predict things like economic trends and consumer behavior. This is key for planning and decision-making.

Linear Regression: From Historical Data to Future Insights

With linear regression, we use old data to guess future trends. This lets us make better decisions and strategies based on data.

Linear regression is a statistical technique used to unlock predictive power by creating a linear equation that models the relationship between a target variable and one or more predictor variables. It is a valuable tool in predictive modeling, helping businesses gain a competitive edge by making accurate predictions and informed decisions. The process involves fitting a best-fitting line to the data, taking into account factors such as categorical variables, standard error, and coefficient of determination.

By analyzing the slope coefficients, model coefficients, and beta coefficients, businesses can identify causal relationships and make predictions with confidence. Through iterative processes such as cross-validation and feature engineering, linear regression can be used to build complex models that accurately predict outcomes based on a wide range of input values. By incorporating advanced machine learning techniques such as neural networks and Lasso regression, businesses can enhance the accuracy and reliability of their predictions. With the right approach and careful consideration of assumptions such as linearity and independence of predictor variables, linear regression can provide valuable insights and drive informed decision-making. (Source: medium.com)

Linear regression analytics is a powerful tool that can unlock predictive power in a variety of applications. By utilizing key concepts such as constant variance, cross-validation, and machine learning algorithms, analysts can effectively predict outcomes based on a set of predictor variables. Factors such as variance inflation and correlation coefficients play a crucial role in determining the accuracy of the model. The cost and loss functions, along with the iterative process of model building, help in fine-tuning the predictions. In the context of real estate, for example, variables like square footage and dummy variables can be used to predict housing prices based on various factors.

By understanding the relationships among predictor variables and using regression coefficients, analysts can create accurate predictive models for various scenarios. The use of techniques like L2 regularization and Lasso regression further enhance the accuracy of predictions, making linear regression a fundamental machine learning algorithm in prescriptive analytics. Sources: ISLR (Introduction to Statistical Learning with Applications in R) by Gareth James, Daniela Witten, Trevor Hastie, and Robert Tibshirani; Python Machine Learning by Sebastian Raschka and Vahid Mirjalili.

FAQ

What are the key assumptions behind a linear regression model?

Linear regression relies on assumptions like a straight-line relationship and errors being random but consistent. These rules help ensure the model’s predictions are reliable.

How is the linear regression equation formulated?

The equation of linear regression links the thing we want to predict to things that predict it. It shows how each predictor affects the outcome.

Building Accurate Predictive Models with Linear Regression

To get good predictions with linear regression, we pick the right predictors and check the data fits the model’s needs. Then, we find the model’s formula to forecast accurately.

Interpreting Regression Coefficients for Strategic Insights

Understanding regression coefficients shows us how our predictors influence our target. This tells us about their impact and helps make smart decisions.

Enhancing Decision-Making with Linear Regression Outputs

Linear regression’s results improve our decision-making by showing how good our model is. This helps us plan and predict with more confidence.

What are some advanced linear regression techniques?

We use advanced methods like polynomial regression for curves, ridge regression for overlapping predictors, and Elastic Net for selecting features. These help tackle common problems and improve our models.

How do we master the interpretation of linear regression results?

Mastering interpretation means understanding key metrics like the R-squared value and regression coefficients. Analyzing these helps us know the strength of relationships and predict accurately.

Can you give examples of real-world applications of linear regression?

For sure! Businesses use linear regression for things like predicting sales and assessing risks. Examples include a retailer forecasting sales from promotions, or a real estate firm predicting house prices from factors like size and location. These show how useful linear regression is in business forecasting.

Q: What are predictor variables in linear regression analytics?

A: Predictor variables, also called input variables, are the independent variables used in a linear regression model to predict the value of the response variable.

Q: How is the relationship between predictor variables and response variables determined in linear regression analytics?

A: The relationship between predictor variables and response variables is determined by fitting a best-fit regression line that minimizes the squared errors or the squared difference between the predicted values and the actual values.

Q: What is the importance of linear regression algorithm in predictive modeling?

A: Linear regression algorithm is a powerful tool in predictive modeling as it helps in understanding the relationships between variables, making predictions about future values, and gaining insights into complex relationships within the data.

Q: How does linear regression differ from logistic regression?

A: Linear regression is used for continuous response variables, while logistic regression is used for categorical response variables. Linear regression predicts the output variable as a linear function of the predictor variables, whereas logistic regression predicts the probability of a certain outcome.

Q: What are some common applications of linear regression analytics in business?

A: Linear regression analytics is commonly used in predicting stock prices, analyzing relationships between variables in business analytics, and making predictions for real-time applications such as future sales forecasts and customer behavior.

References:

– Duxbury Thomson Learning: cengage.com

Secure your online identity with the LogMeOnce password manager. Sign up for a free account today at LogMeOnce.

Reference: Linear Regression For Predictive Analytics

Mark, armed with a Bachelor’s degree in Computer Science, is a dynamic force in our digital marketing team. His profound understanding of technology, combined with his expertise in various facets of digital marketing, writing skills makes him a unique and valuable asset in the ever-evolving digital landscape.

Password Manager

Password Manager

Identity Theft Protection

Identity Theft Protection

Team / Business

Team / Business

Enterprise

Enterprise

MSP

MSP